Credit

Card Processing Flows and Participants

Sportsman requires

integration with a credit card processing system. This allows patrons to swipe or use a chip

reader to use their card for purchases at your center or use a credit card for

a registration or reservation purchase on your ActivityReg website. It also permits the use of the Card on File

feature as well as contributing to financial reporting, reconciliation and

distribution of proceeds from card charges.

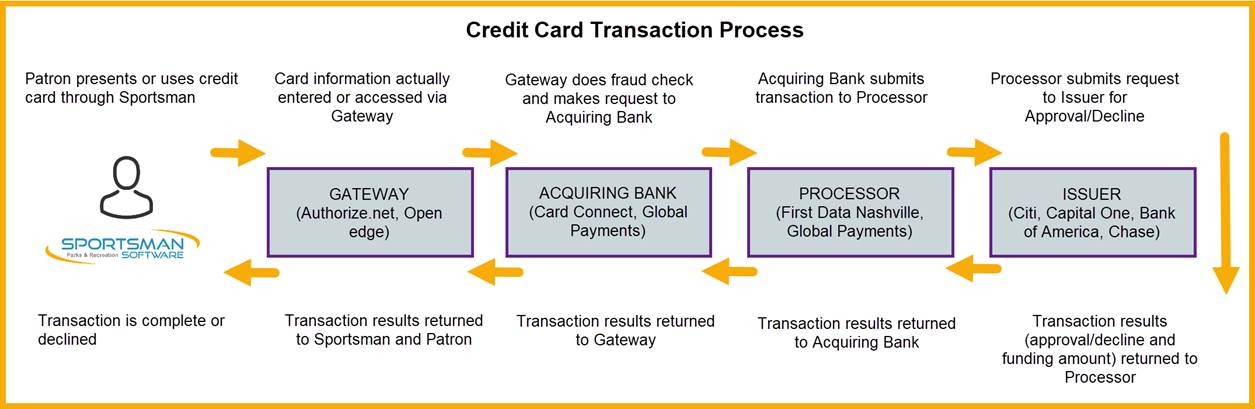

Card Transaction Flows

There are many

participants in the flow of a credit card transaction and it is helpful to

understand these participants as well as the flexibility each may have to work

with other specific companies in the process.

If your community currently uses a specific Acquiring Bank for credit

card transactions, they may partner with a Gateway that is supported by

Sportsman or you will be required to work with your Acquiring Bank to identify

and partner with a Gateway that integrates with Sportsman and a Processor that

can handle the specific technology that you require (such as EMV/Tap to Pay). (For example most Acquiring Banks can use a Gateway

and Processor that will work with Sportsman, however they are likely only to

recommend their preferred or in-house Gateway and

Processor.) In some cases it is necessary to identify a

new Acquiring bank that works with a Gateway that Sportsman integrates

with.

Participants

Sportsman

(PCI Mode): Credit card

information is never entered into your Sportsman database as the software

seamlessly pulls up a card transaction window from your selected Gateway. The full account numbers stored with Card on

File feature are located in an encrypted vault separate from your database and

stored with your Gateway.

Gateway: This may also be referred to as a Technology Provider

or the Acquiring/Merchant Bank’s Payment Software. The Gateway is the

technology and account that Sportsman integrates with. Your gateway account credentials are entered

into Sportsman Site Configuration and encrypted. The role of the Gateway is to begin

communication of the transaction request from Sportsman through the processing

flow and to communicate is final approval or decline back to Sportsman. The Gateway checks account numbers quickly

for validity and fraud markers and then passes the information to the Acquiring

Bank. A Gateway can be associated with

or in some cases can be a distinct vendor from the Acquiring Bank. A list of gateways we integrate with are

provided on our Technical Support website and include Authorize.net and Open

Edge.

Acquiring

Bank: May also be referred to as the Merchant

Bank or Processing Bank. There is a wide variety of banks that can serve as the

Acquiring Bank. Most Acquirers CAN use a

variety of gateways and processors, however many of the larger banks have their

own Gateways and Processors and may not offer to set up an account with other participants

in the marketplace that may integrate with Sportsman. You will need 2 merchant accounts to use with

Sportsman: a ‘card present’ account if

you are accepting cards in person, and an ‘online/non card present’ account for

your ActivityReg patron website. These accounts are tied to the Gateway

credentials entered into Sportsman. The Acquiring

Bank receives information about the requested transaction from the Gateway and

passes it on to the Processor. Examples

of Acquiring Banks include Card Connect and Global Payments.

Processor: These are large companies that are also

referred to as Interchanges or the Processing Platform. Examples include First

Data Nashville and Global Payments. These provide the card authorization and

settlement by connecting directly to the Card Brand networks (Visa, Mastercard,

Discover, American Express) and their Issuer Banks. Not all processors offer

EMV technology so it is important that your Acquiring Bank is willing to

partner with a Processor that can handle these.

The Processor receives transaction details from the Acquiring Bank and

passes it to the Issuers/Sponsor Banks.

Issuer/Sponsor

Bank: These are the credit card

issuing banks (Citi, Chase, Capital One, Bank of America, AmEx) who Sponsor the

Credit Card Brands. They provide the

approvals or declines, put holds on credit transactions and are involved with

the Processor in final settlement funding. Approvals or declines along with the funding

information is passed back to the Processor, then Acquiring Bank, then Gateway

to signal to Sportsman the result of the charge request.

Deposit

Bank: Your community will have a bank

account with a local or national bank where the proceeds from credit card

transactions are ultimately deposited and potentially the credit card fees are

withdrawn. This does not need to be the

same as the Acquiring Bank, but might be.

Credit

Card Brands: Visa, Mastercard,

American Express, Discover

The

Merchant: The Sportsman Client is referred to as the merchant because

they are selling services and posting card charges thru Sportsman.