Payment Plan Module

The Sportsman Software Payment Plan Module is method

of defining a schedule of when payments are made.† It is not a new financial

transaction, rather a schedule definition that tells Sportsman when to process

a payment for a patron and where to apply that payment. Credit Cards are always

the method used to make those installment payments, and you can choose to run

those payment batches manually or allow the system to do it automatically.† If

at any time you find yourself in need of additional support, please contact our

Technical Consultants at support@peakinfo.com or 801-572-3570 x2.

Prerequisites:†

You must purchase the Payment Plan module in order to define payment plans. To

license the Payment Plan Module, navigate in the Sportsman Desktop Application

to File > Administration > Licensing/Renewals, then click Renew/Edit,

check the box next to Payment Plan and click the Renew button.

This Document will cover:

Activating and Configuring Payment Plan

Settings

Defining Payment Schedules

Enabling Payment Plans on Programs or

Activities

Selecting Payment Plan During the

Registration Process

Managing Payment Plan Transactions

Frequently Asked Questions

Configuring Payment

Plan Settings

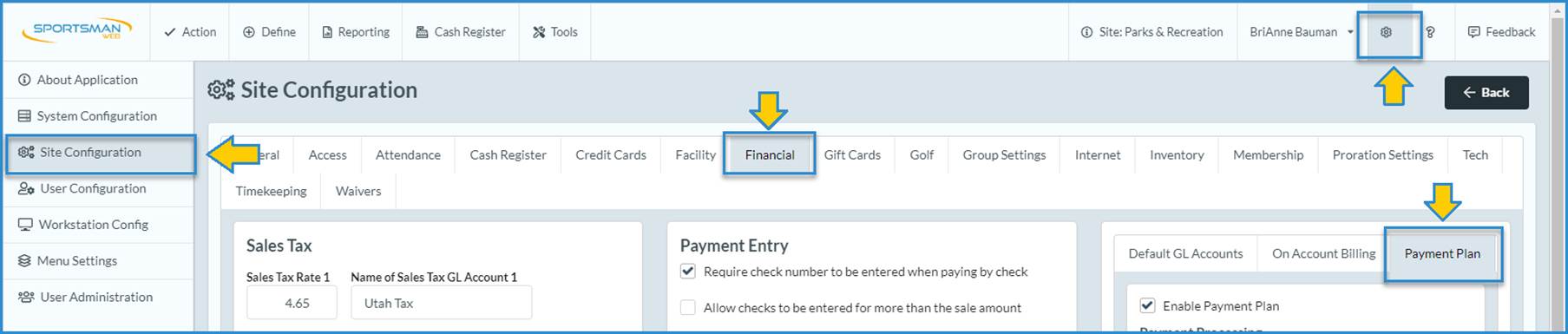

To enable payment plan, select the settings

cog in the upper right-hand corner and navigate to Site Configuration

> Financial tab.

Select the Payment Plan tab.

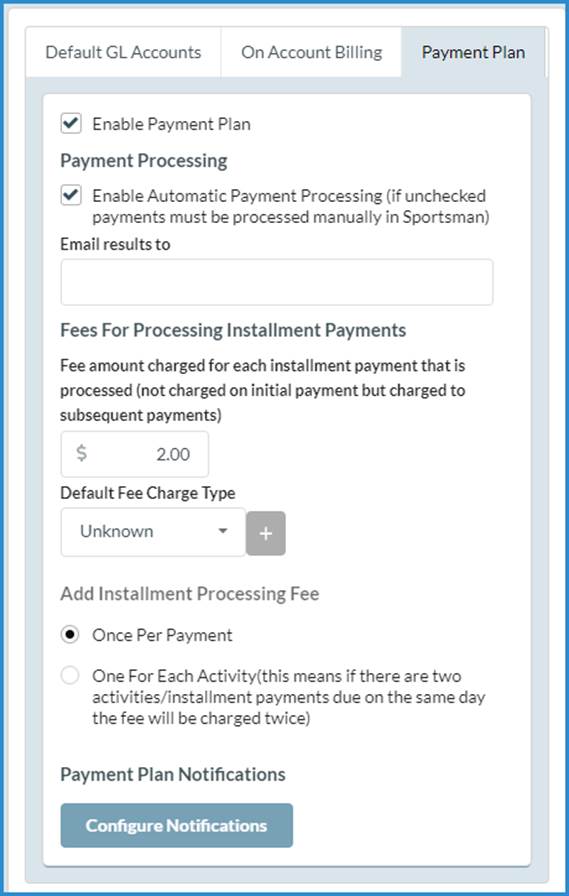

Enable Payment Plan: Turns on Payment Plan

Payment Processing: This determines whether scheduled payment plan charges and

notifications will be run automatically, or will need to be manually initiated.

In manual mode, the processing doesnít happen without someone logging into the

Payment Plan Processing screen to initiate the action. Cloud-hosted customers

will typically select the Automatic Payment Processing mode, which

enables Sportsman and Peak Software to process the credit card charges and

notifications every morning beginning at 6 am mountain standard time.

Email Results To: The email address entered in this field will receive a daily report of

the number of transactions processed successfully, and the number of failed

transactions. If blank, the processing still happens, but no report is

produced. This report is only generated in Automatic Payment Processing mode.

Fees For Processing Installment Payments: This is an additional fee you may choose to charge

for each payment installment on a payment plan. Installment Charges do not

apply to the initial registration amount, but is added to future payments. You

may set this fee to zero if you choose not to charge an installment fee.

Default Fee Charge Type: Fee code used in the transaction to charge the

Installment Fee.

Add Installment Processing Fee: You can choose to assess the installment fee once for

each payment made regardless of how many activities are included, or once for

each activity.† In most cases, once per payment will be the desired choice.† It

is important to note that if you charge a convenience fee for using credit

cards, this will be added separately.

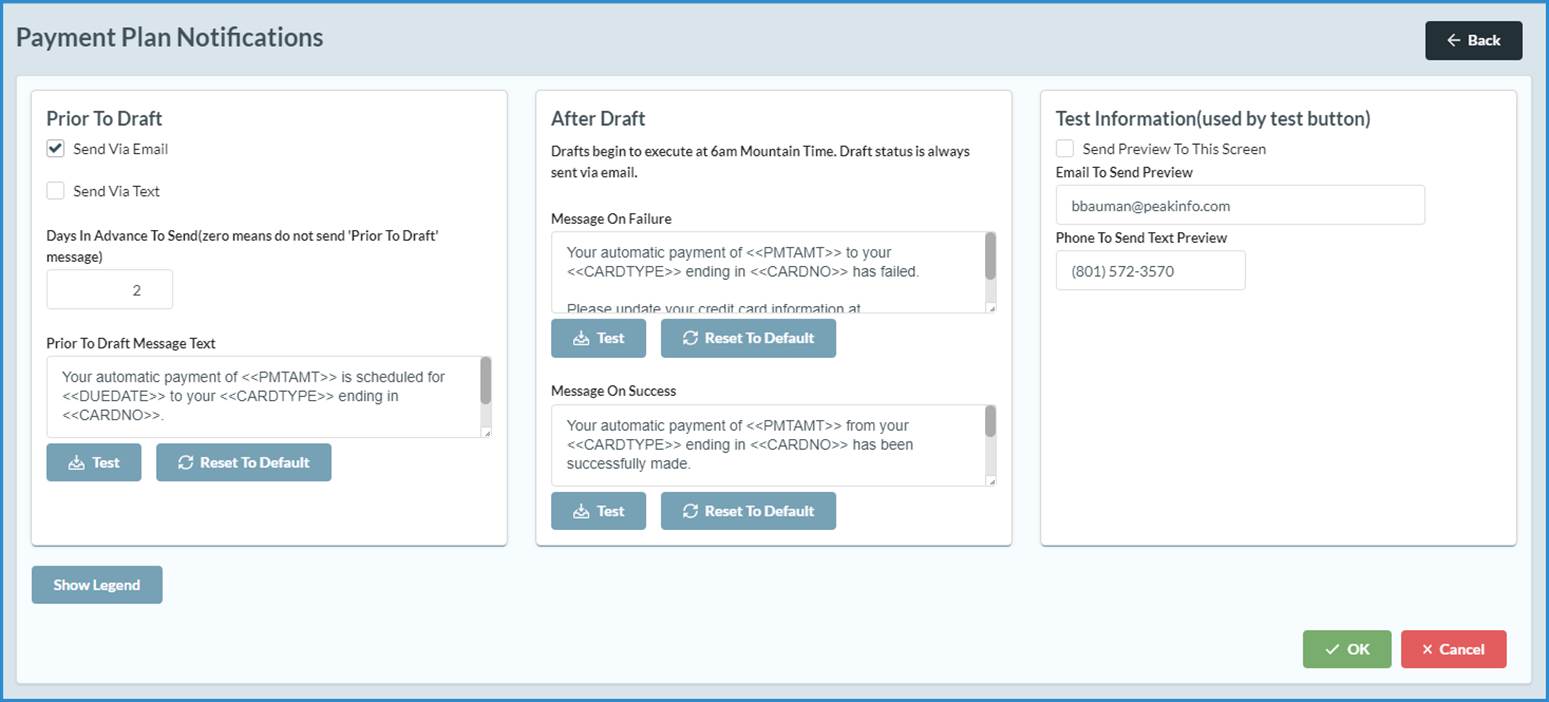

Configure Notifications:

You can send notifications by Email or Text.† If you

choose text, be aware that texting charges apply.† We do not recommend you send

texts unless you are enrolled in the Pay As You Go Text program as texts will

fail after the free limit of 1,000 texts is reached.

Days In Advance to Send: This is the number of days in advance to send out the

notification of pending draft.† If set to 1, the notification will be sent at

6:00 am mountain standard time the day before the scheduled payment.

Customize Messages: All of the messages can be customized. See the [Show Legend]

button to see a list of insertable fields for your message.† To preview the

message, enter test email or cell phone information in the Test Information

area and press the Test button next to the message.

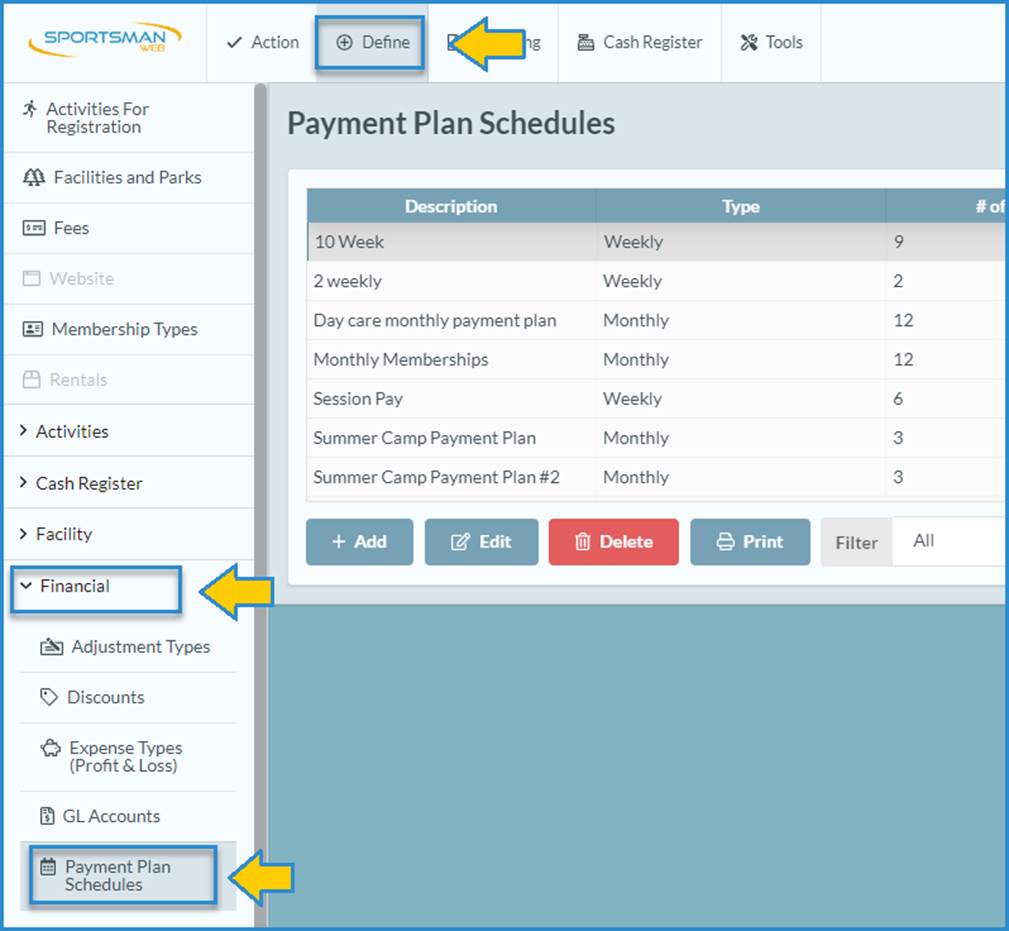

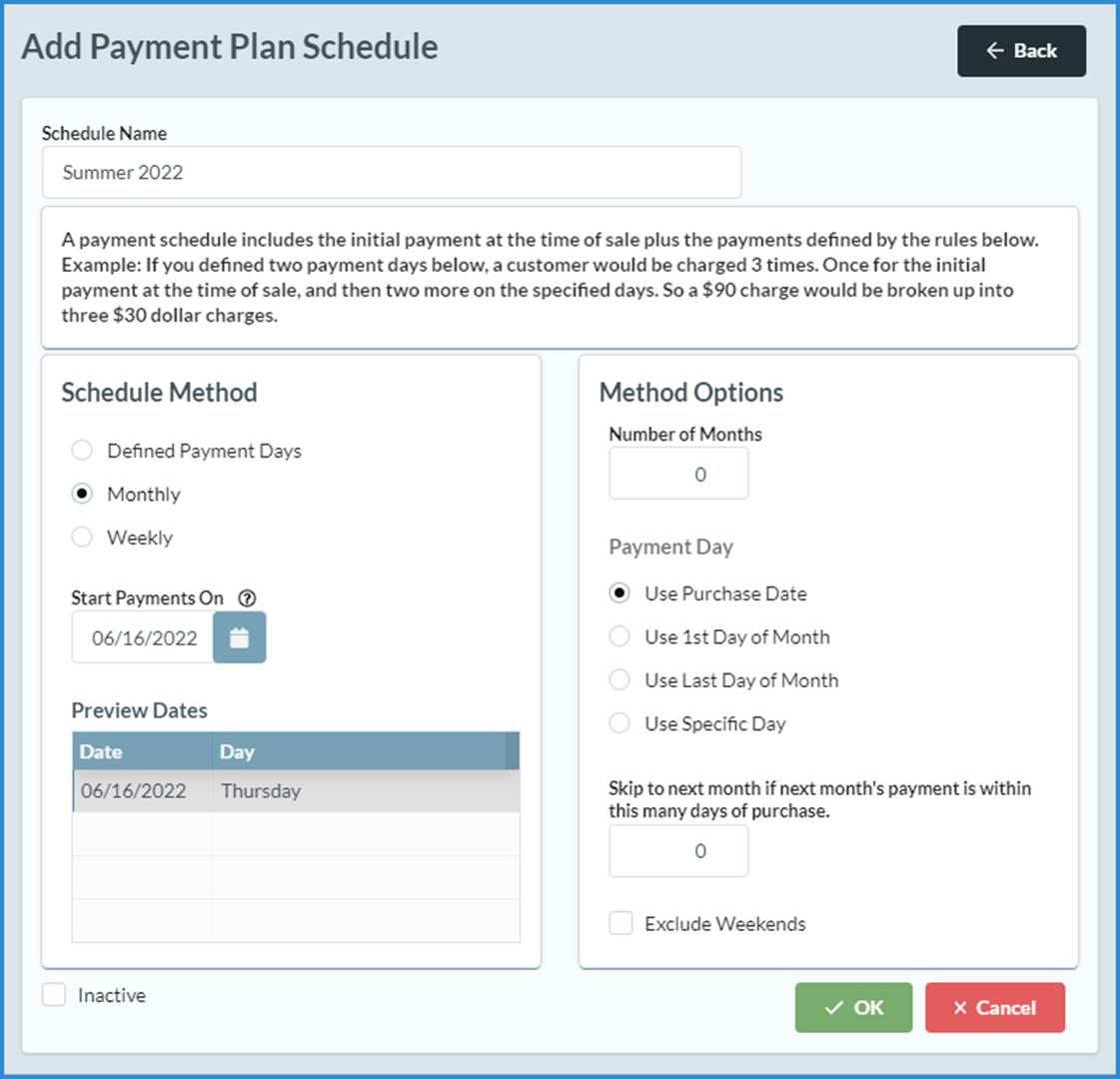

Defining Payment

Schedules

Payment plan schedules allow you to define

when payments will be made.† By defining a schedule that will later be assigned

in the Activity Definition, you avoid having to setup the same data over and

over again. To Define a Payment Plan Schedule, navigate to Define >

Financial > Payment Plan Schedules

Select the [+Add] button to proceed

to the Add Payment Plan Schedule screen.

Schedule Methods:

Defined Payment Days: In

this mode you will select specific days you want the payments to be made on.†

It is important to note that if the dates have expired, the payment plan

assigned to the activity will only contain future dates.

Monthly: In this method you can choose how many

months the plan is divided on.

Skip To Next Month If Next Monthís Payment

Is Within ____ Days of Purchase: Use this option to avoid assigning a payment too close to the

original sale.

Weekly for _____ Weeks: Make payments each week.

Inactive: Use this checkbox to remove expired

payment plans from the list.

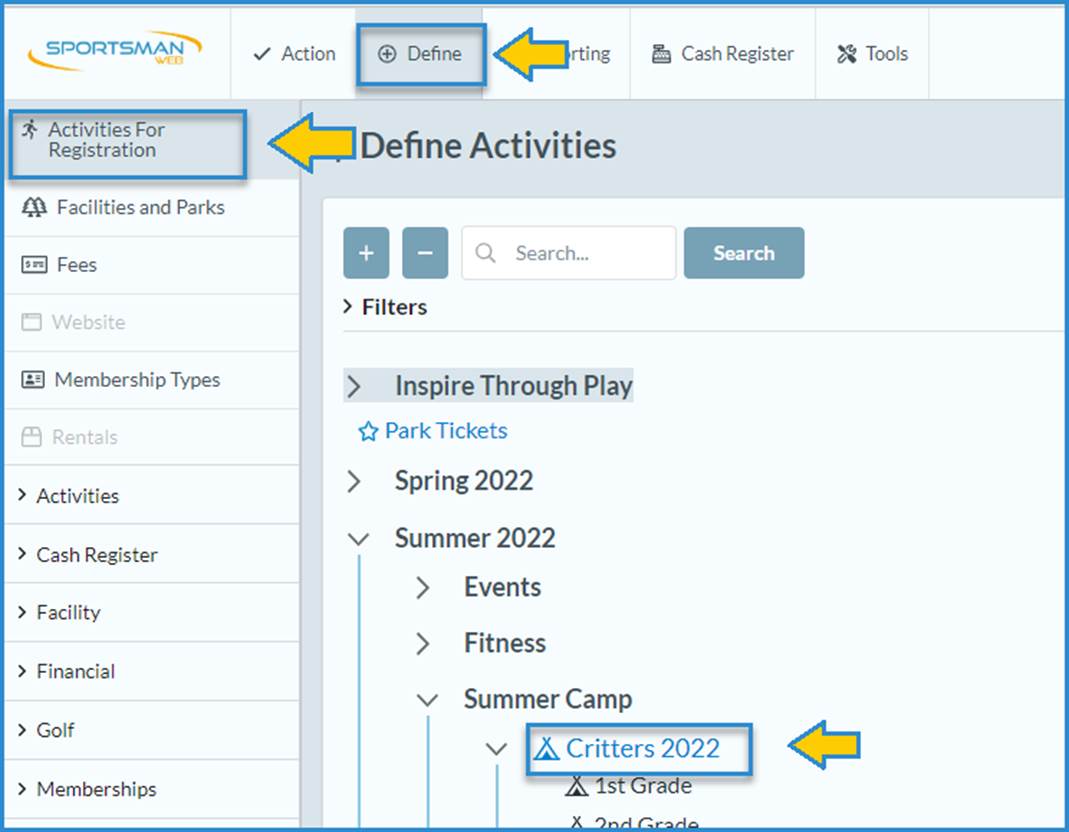

Attaching Payment

Plans to Activities

To attach or enable a payment plan on

activities, navigate to Define > Activities for Registration,

select the activity you want to edit and double-click or click [Edit].

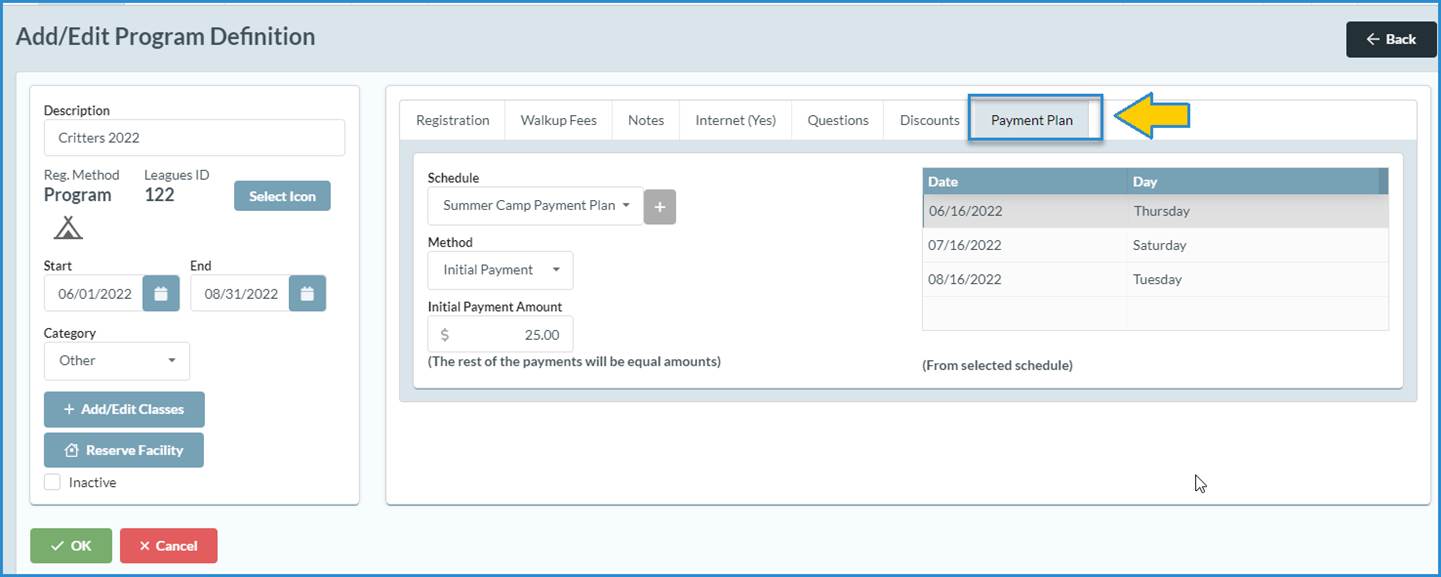

Select the Payment Plan tab.

Schedule: Select the pre-defined payment schedule to

correspond with your activity. You may also choose to define a new payment plan

for your activity by selecting the [+] button.

Method: You can select a different amount for the initial payment

or equal payments for all.† If the initial payment option is selected, it can

be zero if desired but the other payments will be divided equally.

Payment Days: This list shows when the payments would

be due if a registration is made today.† Note that the current date is always

the 1st or initial installment which is collected during the registration

process.

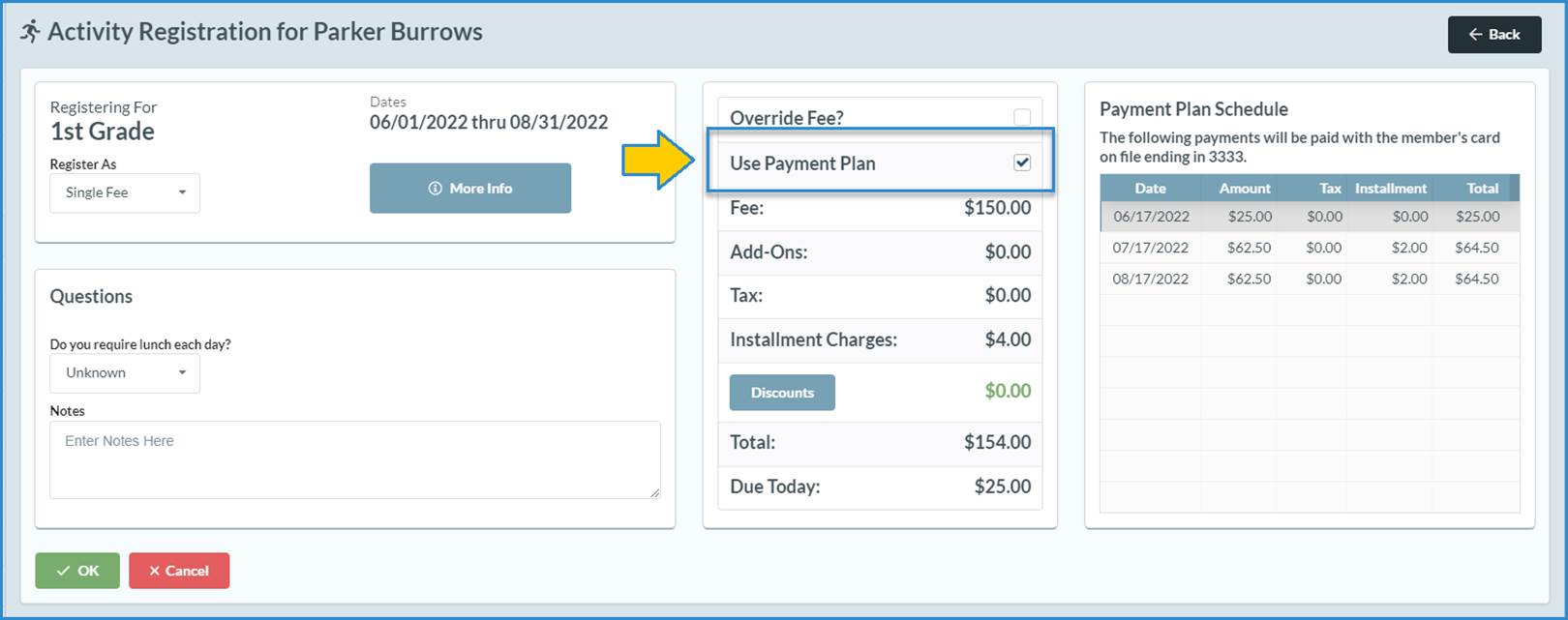

Selecting Payment Plan During the

Registration Process

Choosing to utilize a payment plan is as

simple checking the [Use Payment Plan] box.† If the patron does not have

a Card on File, Sportsman will prompt you to enter one.† The total will then

include the price of the registration as wells as any installment charges on

future scheduled payments. This will allow you to view the total out of pocket

cost for that registration with the payment plan. Once a payment plan is

selected, the Due amount will show the amount that will be due today and shown

in the cart.† The patron will have to pay this entire amount.† Partial payments

are not allowed on installments when using a payment plan.

††††

††††

Managing Payment Plan Transactions

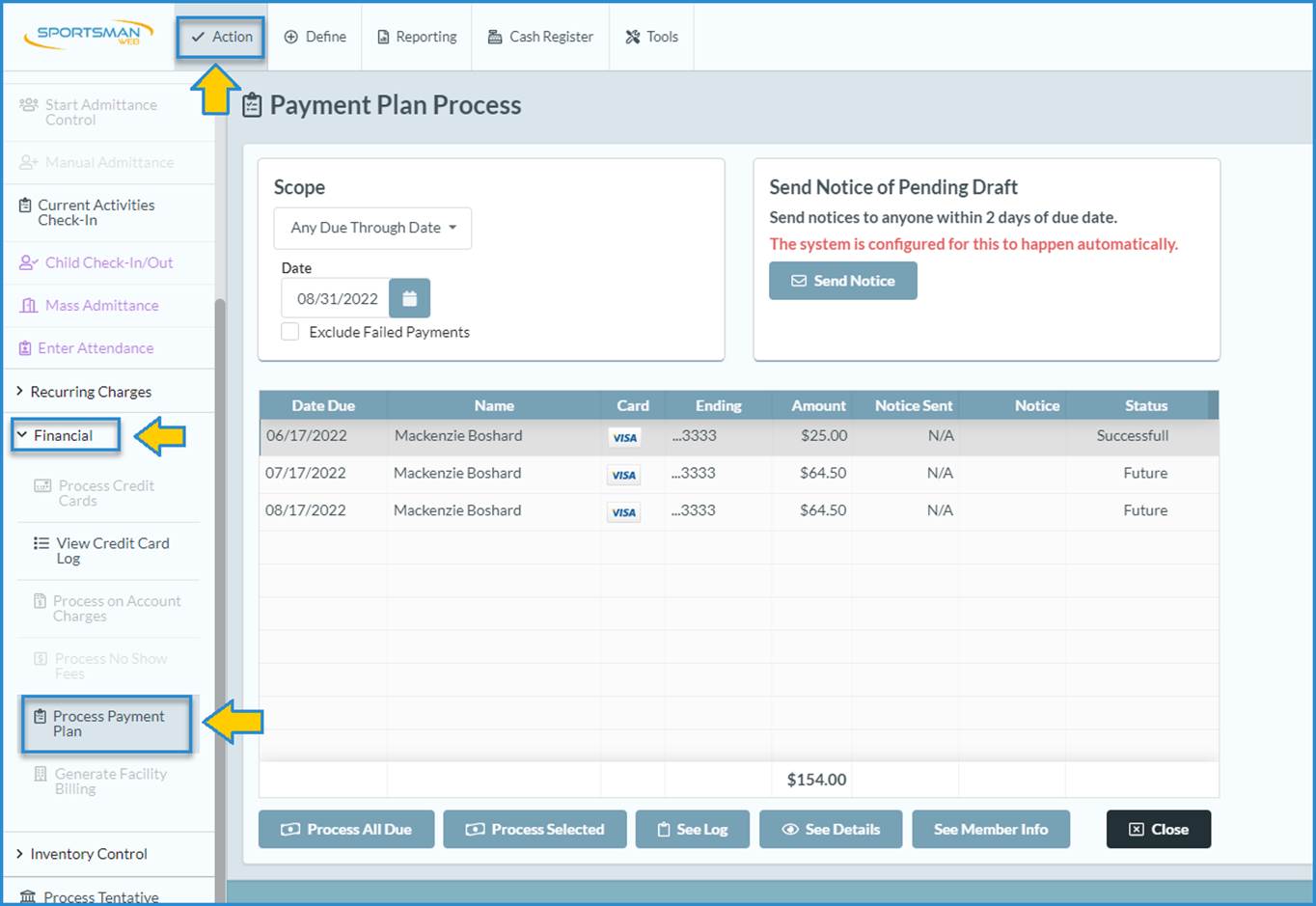

Access the Payment Plan Process screen by

navigating to Action > Financial > Process Payment Plan.†

When in Automatic Process mode, the payments will be processed automatically

but you will still use this screen for handling failed payments, as well as

viewing the log of transactions.

Manual mode will require that you access

this screen prior to draws and press the Send Notice button and then Process

All Due Payments at the date and time you want that to happen.† If you forget

to send notices, Sportsman will not send notices on the day of the scheduled

withdrawal.† It will, however, send the appropriate result notification.

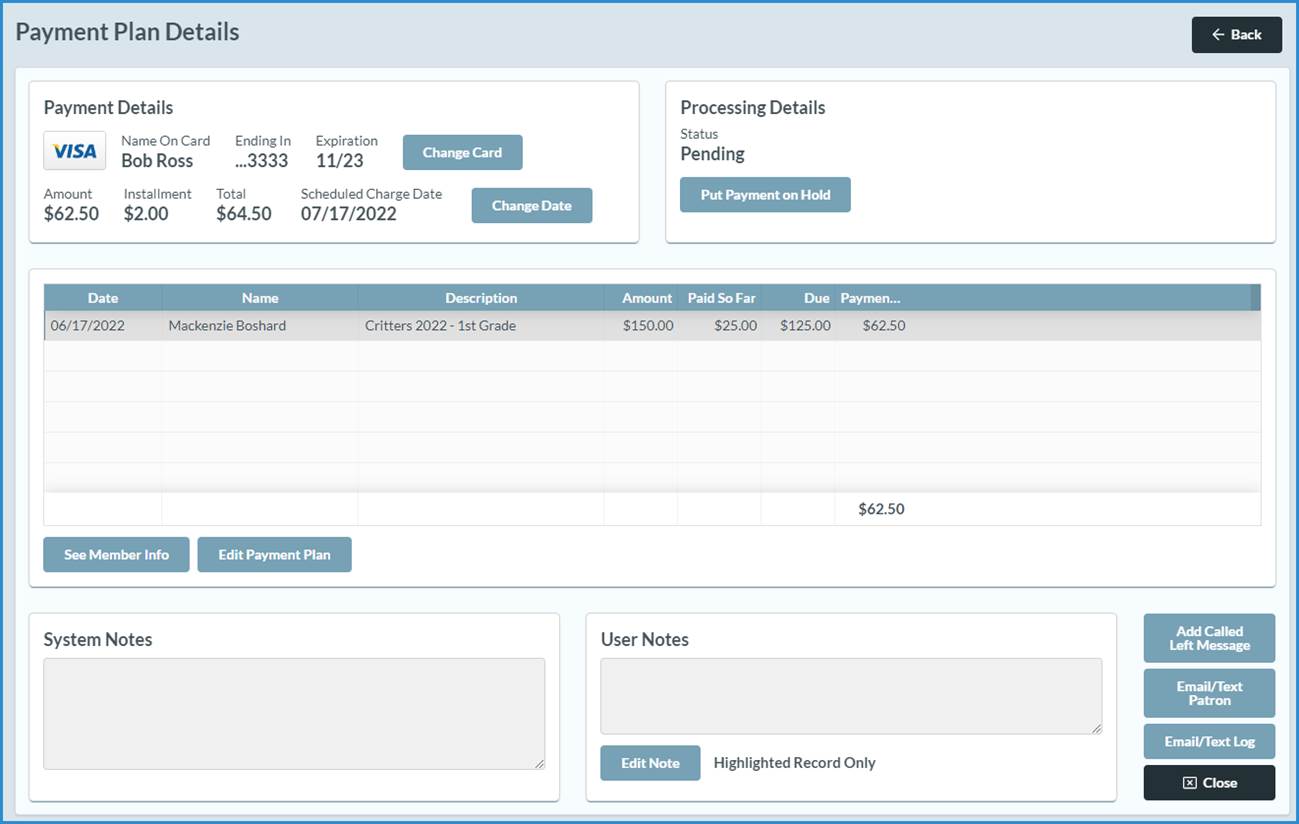

See Details: Double clicking on any item in the list

will press the See Details button and bring up the details screen.† This shows

the amount of the scheduled withdrawal and the registered items the installment

will pay for.

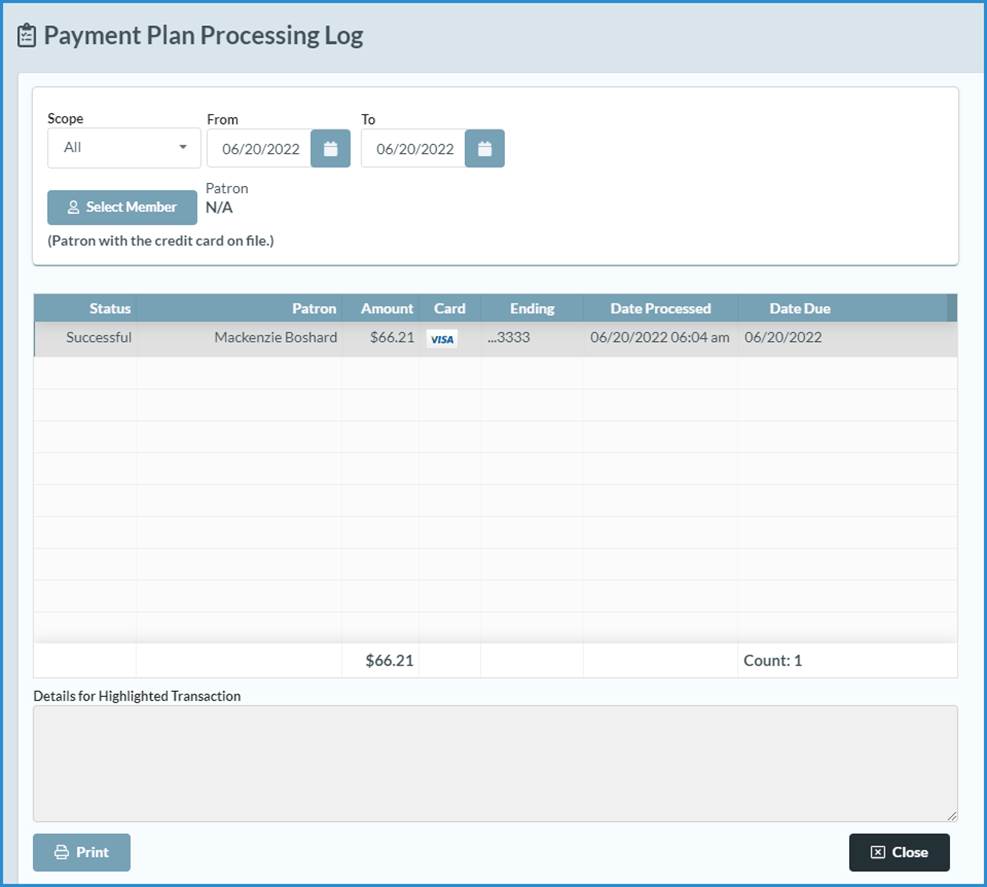

See Log: This accesses the payment processing log to show detailed

information about each payment record that was processed.

Put In Queue to Retry: Sportsman will only try to charge a payment once.† If

the customer tells you to retry, then this button changes the status so that it

will be processed in the next run.† When you return to the prior screen, you

can also process that payment immediately if desired.

Edit Payment Plan: Allows you to edit the payment plan dates and amounts.

System Notes: System

notes automatically record and payment processing details, change of card on

file, etc.

User Notes: This

is a place for you to keep notes of customer interactions, or any in- house

notes regarding the transaction.

Frequently Asked Questions

Question:††††††††††† If a customer uses

ActivityReg or comes in-house and makes a payment, does the amount of the remaining

payments on the payment plan get reduced?

Answer:† Yes, the schedule gets

recalculated but the amounts do not change except for the last payment or

payments.† In other words, it works like a typical loan, if you make an extra

payment, it comes off at the end.† If the customer makes a payment on

ActivityReg and checks out, they will automatically see updated amounts due in

the Accounts section on the Card on File tab.† Additionally, there is a

built-in safety mechanism in the payment processing operation that verifies the

outstanding balance to make sure it never overpays or attempts to overpay an

activity.

Question:††††††††††† Can I change the

payment plan?

Answer:† Yes, using the in-house app you

can add payments to reduce payment amount, change the date due, change the

credit card, etc.† It is even possible to create two charges on the same day to

different credit cards where the cost may be split between two parents.† However,

Sportsman insists that when you finish editing a payment plan, that the full

amount is accounted for.† Effectively it requires that you have a plan which

will pay off that activityís balance.† An end customer cannot change the

payment schedule through ActivityReg; however, they can update the credit card

information used to pay it.

Question:††††††††††† How does a customer

know when the payment is due?

Answer:† The receipt that prints during

the registration process shows the payment schedule.† You can also access the

payment schedules from the Members screen in the in-house app.† But most

importantly, the customer can access that information directly from their account

tab on the ActivityReg website.† If enabled, the customer will get an email or

text notification prior to the withdrawal.

Question:††††††††††† What happens if a

card doesnít process?

Answer:† On each processing run, an

administrator will get a report of how many charges were successful and how

many failed.† The customer will be notified via email that the process failed.†

They can go into their Account on ActivityReg and update the card information

if their credit card information has changed.† The Payment Plan processing

screen, accessible from the application, will show the failed transactions and

the reason for the decline reported from your payment gateway.† You can then

take the appropriate action in further contacting the customer and resolving

the problem.† You can put the installment back into the processing queue and

either process it immediately or have it picked up on the next run.

Question:††††††††††† When do the Automatic

Processing runs happen?

Answer:† Automatic processing runs daily,

7 days a week, 365 days a year at 6:00 am Mountain Standard Time.† Payments are

processed first, then notifications are sent for future payments based on the

settings in your Payment Plan configuration.

Question:††††††††††† If I sign up for two

activities, does Sportsman charge my credit card twice?

Answer:† No.† The commitment to make a

payment is made at each activity and the amounts attached will only show that

activity.† However, Sportsman looks for all activities which have a scheduled

payment for that date and makes a single charge against the specified credit

card.† In Sportsman, that will show as individual payments to the associated

activities with a single payment.† If the payment plan installments due on the

same day have different credit cards, there will be a separate withdrawal and

transaction representing each credit card.

Question:††††††††††† Does the account show

an overdue balance when thereís a payment plan?

Answer:† No, Sportsman ignores balances

covered by a payment plan when checking to see if an overdue balance message is

necessary.† However, the normal account screen will always show the current

balance including all the unpaid amounts.

Question:††††††††††† Where do the

financial charges go?

Answer:† Charges go into the Internet Till

and process on the credit card account associated with Internet Transactions.

Question:††††††††††† Does Payment Plan replace

Recurring Memberships?

Answer:† Not really, but it is applicable.

You can attach a payment plan to an Annual Membership which may be convenient.†

In the past we would use a recurring monthly membership with an end date after

12 months.† With a Payment Plan, the customer sees the whole balance of what

they committed for and then the installments.† But if itís a monthly membership

that supposed to automatically renew each month, then itís still a recurring

membership.† Recurring means a new charge will be made on a future schedule.†

Payment plan means payments on an existing charge are scheduled for the future.

SM:OTD:M:JUN22